3QFY2019 Result Update | Steel & Power

February 7, 2019

Jindal Steel & Power

BUY

CMP

`135

Target Price

`249

Investment Period

12 Months

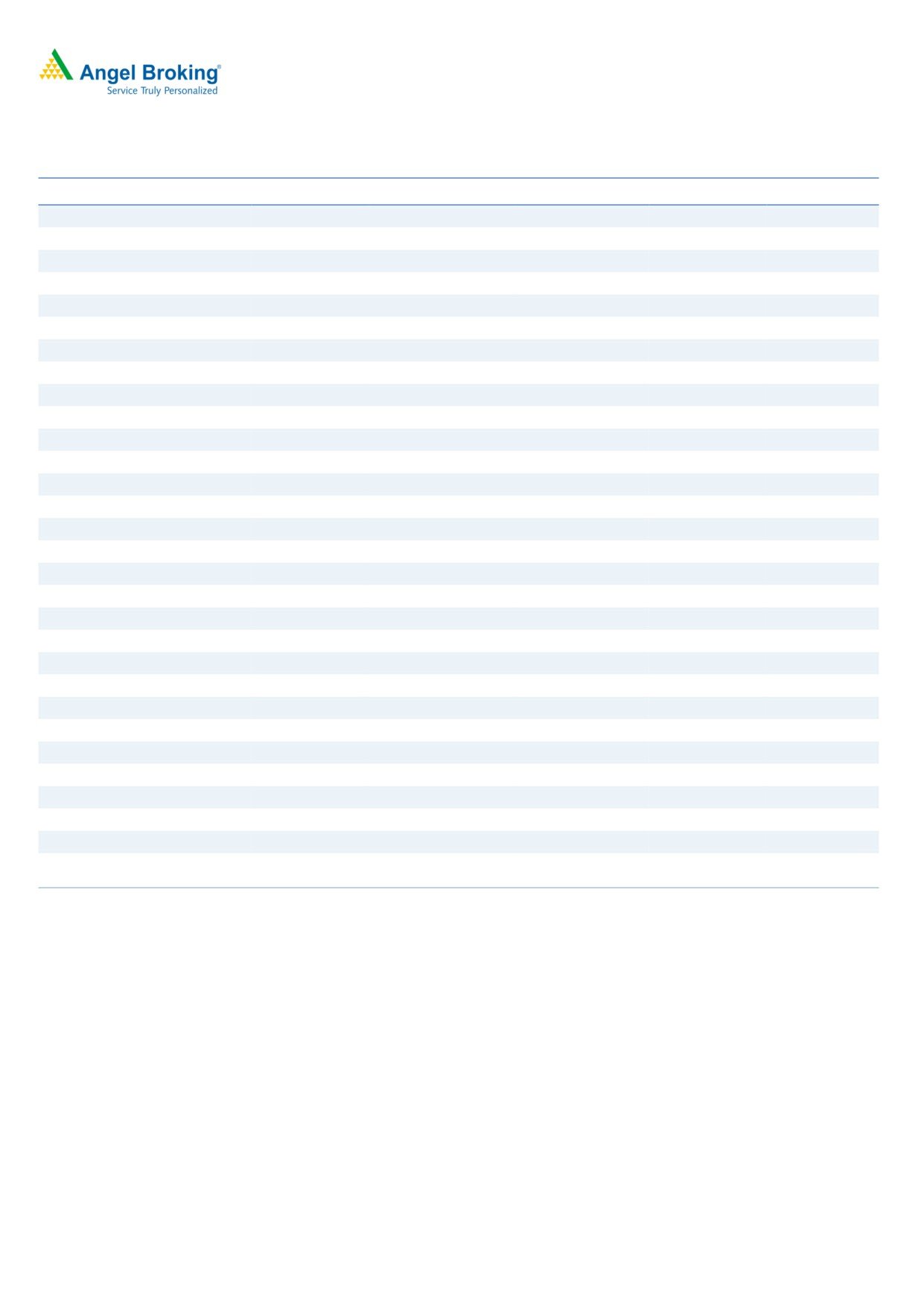

Performance Update

INR Cr.

Q3FY19

Q3FY18

% chg. (yoy) Q2FY19

% chg. (qoq)

Stock Info

Total Income

9580

6993

37

9983

-4

Sector

Steel & Power

Market Cap (` cr)

12,560

Operating profit

2077

1607

29.30

2207

-6

Net Debt (` cr)

39,197

OPM (%)

21.7

23.3

-158.8

22.1

-43

Beta

2.6

52 Week High / Low

279/125

PAT

-86

-123

NA

42

-307

Avg. weekly Volume

1,331,278

Face Value (`)

1

Source: Company, Angel Research

BSE Sensex

36,975

Nifty

11,062

Reuters Code

JNSP.BO

Steel: For Q3FY2019, on standalone basis, JSPL has delivered strong performance and

Bloomberg Code

JNSP IN

registered a revenue growth of 58% yoy to ~`6,754cr. The company’s EBIDTA also

Shareholding Pattern (%)

improved by 61% yoy to `1,480cr owing to better realizations. Further, EBIDTA/tonne

Promoters

58.7

also improved from

`11,344cr in 2QFY2019 to

`12,333cr in 3QFY2019. On

MF / Banks / Indian Fls

6.9

consolidated basis, revenue grew by 37% yoy to `9,580cr as against `6,993cr in

FII / NRIs / OCBs

19.2

Indian Public / Others

15.2

3QFY2018. In 3QFY2019, Jindal Shadeed recorded a production of 0.46mn tonnes of

crude steel, up by 10% yoy. EBITDA for Jindal Shadeed stood at $32mn for the quarter,

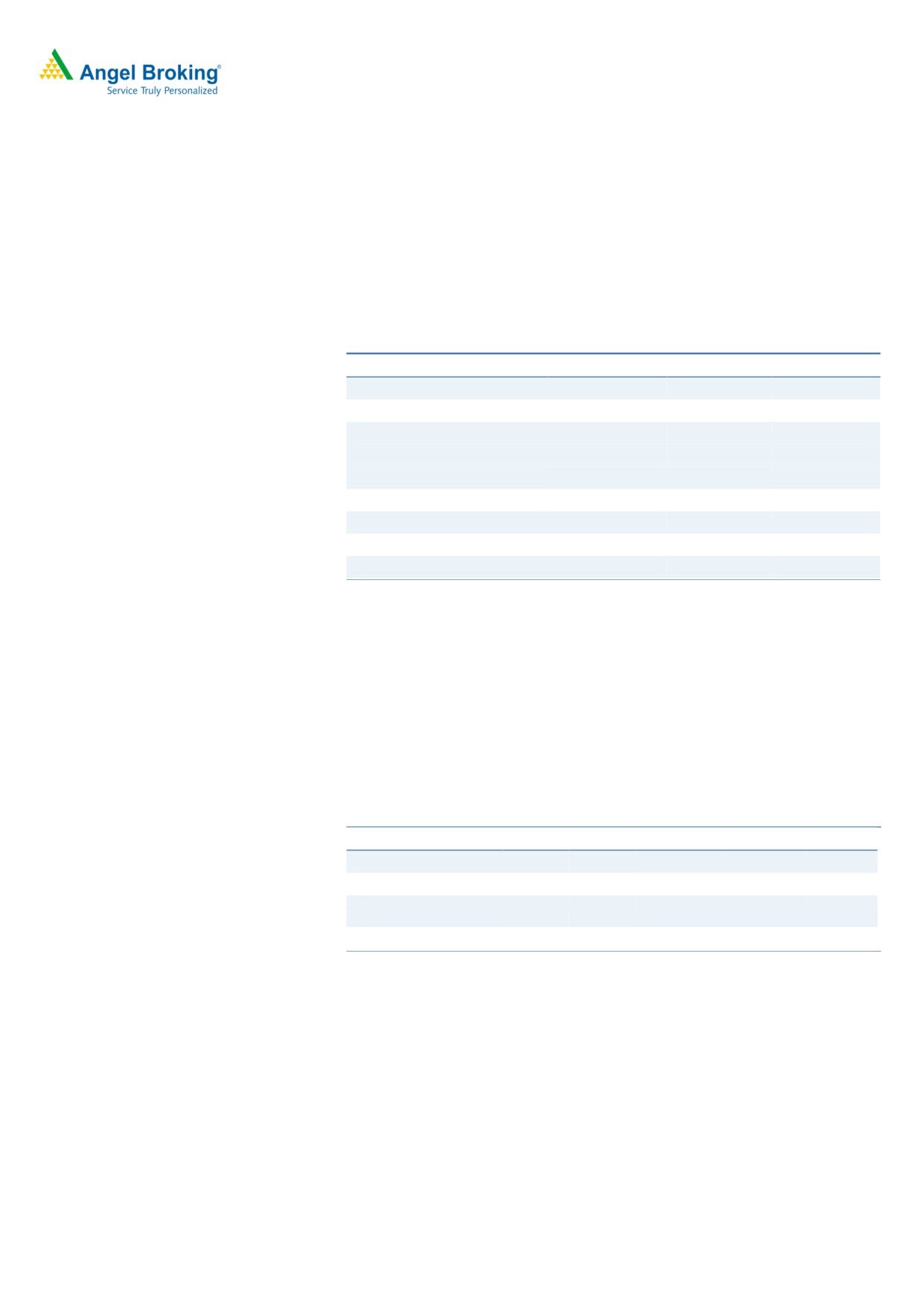

Abs.(%)

3m

1yr

3yr

down 49% yoy owing to weak global steel prices.

Sensex

5.6

5.4

27.0

JSPL

(26.9)

(46.0)

(12.8)

Going forward, we expect EBIDTA/tonne to sustain in the same range owing to stable

global steel prices and increasing domestic consumption of steel. However, recent inch-

up in iron ore prices may impact operating margins, but at same time, it will also

support steel prices. As far as JSPL is concerned, increasing input prices can be offset

against improving utilization at Angul plant.

3years performance chart

JPL: During Q3FY2019, revenue in power segment witnessed de-growth of 14% yoy to

350

`1,004cr vs. `1,172cr in the corresponding quarter previous year. Poor coal availability

300

continued to impact the generation volumes. Generation volumes for the quarter stood

250

at 2,609mn units, down 12% yoy, while EBITDA margin contracted by 318bps yoy to

27% due to higher coal costs and lower generation volumes.

200

150

100

Outlook & Valuation: Given the ongoing global trade concerns, we expect steel prices to

remain range bound. However, we project that domestic demand will continue to

50

remain positive for steel and power sectors on long term basis, and expect JSPL to

0

perform well in coming years along with the ramp up of Angul plant and realizations in

steel segment. We also anticipate that power segment will perform well on account of

improving power demand situation and various efforts by GoI for availability of fuel to

power generators. We maintain our Buy recommendation on JSPL with revised target

Source: Company, Angel Research

price of `249 with a potential upside of 84%.

Key Financials

Y/E March (` cr)

FY17

FY18

FY19E

FY20E

Net Sales

20,409

27,383

38,967

41,512

% chg

14

34

42

7

EBIDTA

4,337

5,882

8,763

10,175

% chg

35

36

49

16

EBITDA (%)

21%

21%

22%

24%

EPS (Rs)

(26)

(17)

9

19

P/E (x)

-

-

15

7

P/BV (x)

0.4

0.4

0.4

0.4

RoE (%)

-

-

2.7

5.6

Kripashankar Maurya

RoCE (%)

0.6

2.9

6.6

8.8

022-39357800 Ext: 6004

EV/EBITDA

11.9

8.7

5.7

4.5

Source: Company, Angel Research

Valuation done based on 6th February, 2019 closing price

Please refer to important disclosures at the end of this report

1

JSPL | 3QFY2019 Result Update

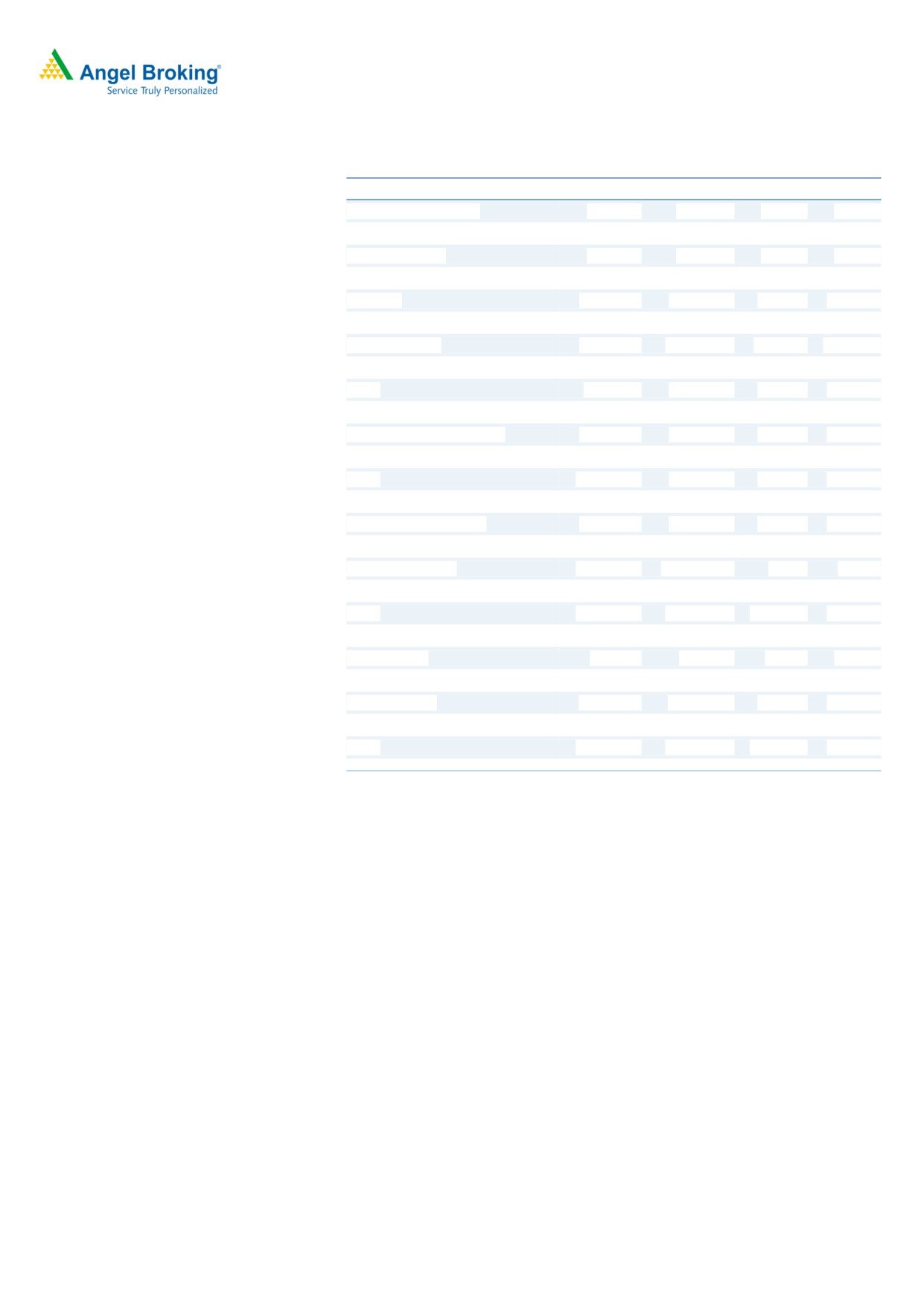

Exhibit 1: 3QFY2019 Performance

In Cr

Q3FY19

Q3FY18

Q2FY19

YOY %

QOQ%

Net Sales

9580

6904

9983

38.8%

-4%

Total Income

9566

6993

9982

37%

-4%

Total Expenditure

7488

5386

7775

39%

-4%

Raw Material Consumed

3856

2217

3999

74%

-4%

Stock Adjustment

-371

85

78

-538%

-573%

Purchase of Finished Goods

277

54

280

408%

-1%

COGS

3761

2356

4357

60%

-14%

Employee Expenses

279

241

269

16%

4%

Other Expenses

3527

2789

3222

26%

9%

Capitav sales

-79

0

-63

Raw Material Consumed

40%

32%

40%

Stock Adjustment

-4%

1%

1%

Purchase of Finished Goods

3%

1%

3%

COGS

39%

34%

44%

Gross Margin %

39%

34%

44%

Employee Expenses

3%

3%

3%

Other Expenses

37%

40%

32%

EBITDA

2077

1607

2207

29%

5%

Other Income

14.77

1.0

0.0

1320%

#DIV/0!

Interest

1042

967

973

8%

7%

PBDT

1050

641

1234

64%

-15%

Depreciation

1036

963

1039

8%

0%

PBT

14

-323

195

-104%

-93%

Exceptional Iteam (gain/loss)

0

0

0

NA

Tax

100

-200

154

-150%

-18%

PAT

-86

-123

42

-30%

24%

Ratios

BPS

BPS

EBITDA margin (%)

21.7

23.3

22.11

-159

-43

PAT margin %

0

0

0.42

1

-43

Tax rate %

NA

62

78.71

NA

NA

Source: Company, Angel Research

Company background

JSPL is part OP Jindal Group with presence in steel, power and mining sectors.

JSPL has capacity of

10.6 MTPA crude steel and 3,400MW of power

generation capacity through its subsidiary Jindal Power Limited (JPL).

JSPL operates the largest coal based sponge iron plant in the world and has

an installed capacity of 3 MTPA (million tonnes per annum) of steel at Raigarh

in Chhattisgarh. Moreover, it has set up a 0.6 MTPA wire rod mill and a 1

MTPA capacity bar mill at Patratu, Jharkhand, a medium and light structural

mill at Raigarh, Chhattisgarh and a 2.5 MTPA steel melting shop and a plate

mill to produce up to 5 meter-wide plates at Angul, Odisha. In Oman (Middle

East), the company has a 2 MTPA integrated steel plant with a 1.5 MTPA gas-

based Hot Briquetted Iron (HBI) plant.

February 7, 2019

2

JSPL | 3QFY2019 Result Update

JSPL has installed power capacity of 3,400MW through its wholly owned

subsidiary Jindal Power Limited (JPL). In FY18, JPL had Power Purchase

Agreement (PPA) of 1,350MW and it operates at 35-37% utilization.

Valuation Assumption

We value the stock on Asset based approach, valuing each segment’s assets at

discount to its peer companies, while applying multiple to respective asset. We

arrive at the SOTP based target price of ` 249.

Exhibit 2: Asset Based SOTP Valuation

Segments

Capacity

Multiple (X)

Total INR Cr.

Power- (EV/MW)*

3,400

4

13,600

Steel- (EV/Tonne)#

10.6

4,800

50,880

Consol Enterprise Value (A)

64,480

Debt FY19 (Sept) (B)

42,605

Equity Value ( C)= (A)-(B)

25,283

No of share (D)^

102

Value per share INR (C)/(D)

249

CMP

130

Upside

91%

Source: Company, Angel Research

Note:

*Disinvestment announced in May 2016 by JSW Energy to acquire 1,000MW

(4X250) Tamnar Thermal Power Plant from JSPL.

Valuing Power segment by applying multiple of `4cr/MW at 21% discount to JSW

Energy’s of EV `4.9cr/MW.

# Valuing the steel segment by applying multiple of `4800cr/MTPA at 22%

discount to JSW Steel’s EV/Tonne of ` 5,962cr/MTPA.

^ Factoring issuance of warrant shares.

Exhibit 3: Peer Asset Valuation

Particular

JSW steel Tata Steel JSW Energy Tata power

NTPC

EV/Tonne

5,962

5,898

EV/MW

4.7

5.9

4.6

Crude steel Capacity

18

28

(MTPA)

Power Generation Capacity (MW)

4,451

10,757

52,946

Source: Company, Angel Research

February 7, 2019

3

JSPL | 3QFY2019 Result Update

Exhibit 4: Income statement

Y/E March (` cr)

FY17

FY18

FY19E

FY20E

Total operating income

21,051

27,383

38,967

41,512

% chg

15

30

42

7

Total Expenditure

16,714

21,502

30,203

31,901

Raw Material

6,535

9,378

12,896

13,739

Personnel

914

956

1,361

1,450

Purchase of finished goods

265

324

385

416

Others Expenses

8,999

10,843

15,561

16,090

EBIDTA

4,337

5,882

8,763

10,175

% chg

35

36

49

16

(% of Net Sales)

20.6

21.5

22.5

24.2

Depreciation& Amortisation

3,949

3,883

4,114

4,234

EBIT

388

1,999

4,650

5,941

% chg

(145)

415

133

28

(% of Net Sales)

2

7

12

14

Interest & other Charges

3,441

3,866

3,557

3,220

Other Income

10

3

3

3

Extraordinary Items

(372)

(577)

-

-

Recurring PBT

-2,671

-1,287

1,096

2,388

% chg

(28)

(52)

(185)

118

Tax

-503

-240

252

549

PAT (reported)

-2,168

-1,047

844

1,839

% chg

(24)

(52)

(181)

118

(% of Net Sales)

-10.3

-3.8

2.2

4.4

Basic & Fully Diluted EPS (Rs)

-26

-17

9

19

% chg

(18)

(36)

(152)

118

Source: Company, Angel Research

February 7, 2019

4

JSPL | 3QFY2019 Result Update

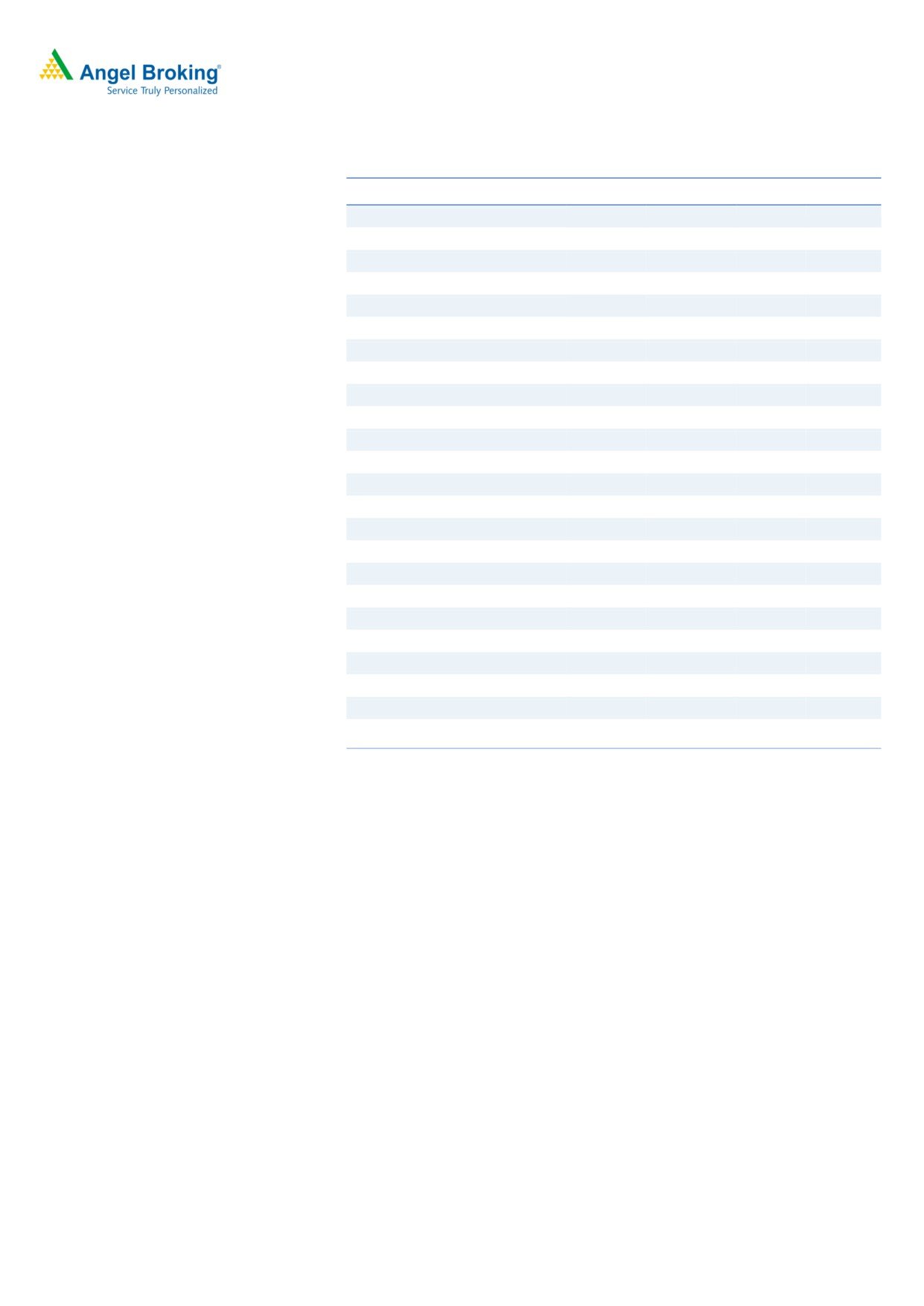

Exhibit 5: Balance sheet

Y/E March (` cr)

FY17

FY18

FY19E

FY20E

SOURCES OF FUNDS

Equity Share Capital

92

97

97

97

Reserves& Surplus

29,959

30,283

31,127

32,966

Shareholders Funds

30,051

30,380

31,224

33,063

Equity Share warrant

5

5

5

Minority Interest

647

440

338

235

Total Loans

39,958

39,198

38,824

34,362

Other Liabilities

6,430

6,074

8,662

8,490

Total Liabilities

77086

76097

79053

76202

APPLICATION OF FUNDS

Net Block

66,934

69,550

67,732

65,997

Capital Work-in-Progress

8,714

3,877

1,947

1,850

Investments

368

146

146

146

Long Term Loans & Advances

-

-

Current Assets

13,022

14,313

20,517

21,045

Inventories

3,599

4,960

6,864

6,536

Sundry Debtors

1,717

1,826

2,600

2,770

Cash & Cash Equivalent

477

468

992

1,389

Loans & Advances

6,841

6,589

9,633

9,640

Investments & Others

387

471

429

450

Current liabilities

13,489

13,133

18,759

19,349

Net Current Assets

-467

1,180

1,758

1,434

Other Non Current Asset

1,537

1,343

7,470

6,775

Total Assets

77086

76097

79053

76202

Source: Company, Angel Research

February 7, 2019

5

JSPL | 3QFY2019 Result Update

Exhibit 6: Cash Flow

Y/E March (` cr)

FY17

FY18

FY19E

FY20E

Profit before tax

(2,671)

(1,287)

1,096

2,388

Depreciation

3,949

3,883

4,114

4,234

Change in Working Capital

Interest / Dividend (Net)

3,441

3,866

3,557

3,220

Direct taxes paid

(503)

(240)

252

549

Others

2,582

(516)

(1,163)

312

Cash Flow from Operations

6,799

5,706

7,855

11,039

(Inc.)/ Dec. in Fixed Assets

(2,354)

(2,000)

(2,499)

(2,498)

(Inc.)/ Dec. in Investments

356

175

(46)

(45)

Cash Flow from Investing

(1,998)

(1,825)

(2,545)

(2,543)

Issue of Equity

0

1,200

-

-

Inc./(Dec.) in loans

-2875.18

-760.44

-374.00

-4462.00

Others

(2,181)

(4,305)

(4,207)

(3,300)

Cash Flow from Financing

(5,057)

(3,866)

(4,581)

(7,762)

Inc./(Dec.) in Cash

(256)

15

730

397

Opening Cash balances

503

247

262

992

Closing Cash balances

247

263

992

1,389

Source: Company, Angel Research

February 7, 2019

6

JSPL | 3QFY2019 Result Update

Exhibit 7: Key Ratio

Y/E March

FY2017

FY2018

FY2019E FY2020E

P/E (on FDEPS)

-

-

14.9

6.8

P/CEPS

7.1

4.4

2.5

2.1

P/BV

0.4

0.4

0.4

0.4

EV/Sales

2.5

1.9

1.3

1.1

EV/EBITDA

11.9

8.7

5.7

4.5

EV / Total Assets

0.7

0.7

0.6

0.6

Per Share Data (Rs)

EPS (Basic)

-26.2

-16.8

8.7

19.0

EPS (fully diluted)

-25.0

-16.0

8.3

18.1

Cash EPS

18.4

29.3

51.2

62.7

DPS

0.0

0.0

0.0

0.0

Book Value

310

314

323

342

Returns (%)

ROCE

0.6

2.9

6.6

8.8

Angel ROIC (Pre-tax)

0.6

2.8

6.1

8.2

ROE

-8.5

-5.3

2.7

5.6

Turnover ratios (x)

Inventory / Sales (days)

64

67

65

60

Receivables (days)

31

25

25

25

Payables (days)

52

56

56

56

Working capital cycle (ex-cash) (days)

43

35

33

28

Source: Company, Angel Research

February 7, 2019

7

JSPL | 3QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Jindal steel & Power

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

February 7, 2019

8